What is trades insurance?

Trades insurance is a business insurance policy that covers tradespeople. It combines several different covers to ensure tradespeople are protected against claims. Trades insurance often includes covers such as:

- Public liability insurance – protects you against claims from third parties for accidental injury or damage

- Employers’ liability insurance – protects you against claims if an employee injures themselves or falls ill as a result of their job

- Tool insurance – covers the cost of replacing your tools that you own or hire if they’re lost, stolen or damaged

- Professional indemnity insurance1 – protects you if you offer advice as part of your contracts

Do I need insurance as a tradesperson?

Business insurance is important because without it you’re liable for the repercussions of any damage caused to a member of the public, your client or their property. As well as compensation costs, business insurance also covers the costs that come from defending a claim against you, attending court, or paying compensation when a claim is successful.

Additionally, some clients might require you to have certain covers in place before you can complete work for them, such as local authorities (councils, government bodies etc) who are likely to request you have, at minimum, public liability insurance.

Here are just a few types of situations that business insurance can help with:

- Accidental injury to the public or your employees

- Accidental damage caused to someone’s property or belongings

- Malicious property/workshop damage

- Break ins or vandalism

- Theft of tools and equipment

What kind of trades do we cover?

Electricians and electrical contractors

You spend your days installing, maintaining and repairing the electrical devices that keep things running smoothly. Business insurance can protect your livelihood if an accident occurs, or someone is hurt due to your work.

Carpenters and joiners

You work with your hands, making things and mending them for customers. From hanging doors and framing windows or installing ceiling grids our business insurance can be tailored to fit your needs.

Painters and decorators

You make a client’s house feel like a home and they rely on your handiwork to make their visions come to life. Having business insurance takes a load of your mind and give you the space to get creative and do what you love.

Builders

Construction provides over 6% of the UK's jobs. With such a large industry there are plenty of risks to consider when you start a construction business. Business insurance can help with the cost of any claims.

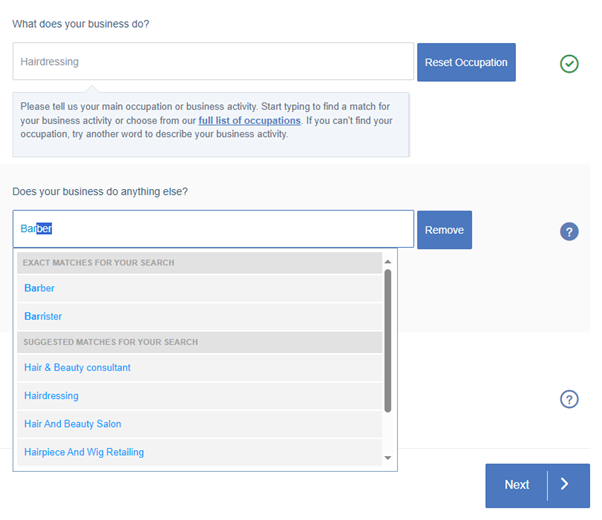

If you don’t see your trade here, don’t worry. Most tradespeople can find the business insurance that’s right for them - simply search for your trade when you get a quote online.

What other types of business insurance do I need?

Whether it’s a client that’s been injured on-site, property damage from an ongoing repair, stolen tools or an employee who’s fallen ill – we’ve got you covered. Here are some of the most commonly chosen covers for trades.

Public liability insurance

If a third party is accidentally injured, or their property is damaged as a result of the work you’re carrying out, public liability will help cover the costs of defending a claim as well as paying out on successful claims with up to £10† million in compensation payments.

Find out moreProfessional indemnity insurance1

Some trades are eligible for professional indemnity insurance if they provide advice, services or designs to their clients. This cover will help with legal costs and expenses incurred in your defence, as well as paying out on any successful compensation claims.

Find out moreEmployers’ liability insurance

If you’ve got people working for you (that includes apprentices, sub-contractors, casual labourers and temporary workers), you’re legally required to have employers’ liability insurance under the Employers’ Liability Act 1969. If an employee falls ill or gets injured as a result of being on the job, you’ll be covered for up to £10 million as standard.

Find out moreVan insurance for trades

Getting from job to job is no easy task when you have to transport tools and materials between sites. For that, you’ll likely have your own van. If you do, you need to make sure you’ve got van insurance.

Optional extras for trades

Along with the main covers that make up your business insurance policy, there are also various optional extras that you can choose to add to your policy.

Plant, tools and equipment insurance

If you own your tools then our own-plant tools cover will protect you for accidental loss, theft or damage. From machinery, trailers or caravans – to the tools and stock that you own too, up to the value of £2000.

Similarly, if you hire in plant, like constructional plant, machinery, tools or site huts – our hired-in equipment cover will protect them if they’re damaged or destroyed whilst in your care.

Contract works cover

If you’re building a new house or extending a property and the project is destroyed or damaged part-way through, contract works cover will protect you against accidental loss, destruction or damage to the new structure. So, you can get back to what’s important - finishing the job.

Personal accident cover

Principals or directors in your firm have an accident? We can help.

Capital cover will give you a lump sum of £10,000 in the event of their death, total disability, loss of limb or sight. If they’re under 75, weekly cover offers them a weekly wage if they’re unable to work – e.g. in the case of a broken arm or leg, until they recover.

How much is business insurance for tradespeople?

There’s no set price that tradespeople pay for business insurance with AXA as this depends on several factors, such your business size, the covers you choose, how many employees you have, your claims history and more.

AXA customers pay prices from £7** per month, or £79*** per year for business insurance with us.

The quickest and easiest way to find out what your policy with us would cost is to get a quote online by clicking the button below.

** 10% of our customers paid from £7.00 for ten months between January and March 2025 after an initial deposit. Interest applicable. For more details see our terms & conditions.

*** 10% of our customers paid this or less between January and March 2025.

Trades insurance FAQs

Our customers say...

Our customers’ reviews, independently moderated and managed by feefo. Based on 0 total reviews.

.

View our privacy policy here.

*Rated 4.6/5 based on 18,675 total reviews. Figure accurate as of 01/05/2025.

1Professional indemnity cover is only available to certain trades

** 10% of our customers paid from £7.00 for ten months between January and March 2025 after an initial deposit. Interest applicable. For more details see our terms & conditions.

*** 10% of our customers paid this or less between January and March 2025.

Underwritten by AXA Insurance UK plc. Terms, conditions, eligibility and exclusions apply.

†Not all occupations are eligible for £10 million coverage, the best way to find out which level of cover you are eligible for is to get a quote. Existing customers may want to consult their policy documents.