Home insurance premiums explained

Across the UK insurance industry, home insurance prices have risen due to claims costs and rising inflation. Find out more about how this might affect you in our guide.

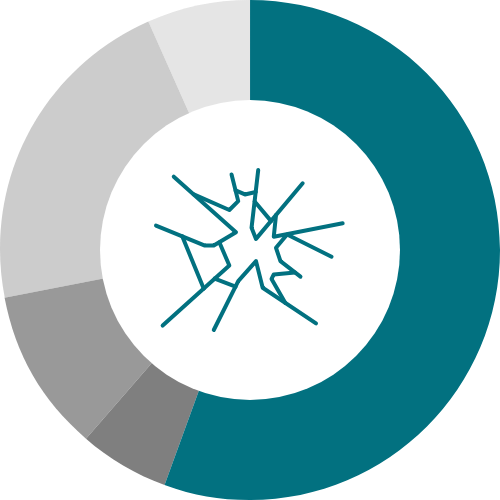

Home insurance premium split

Trying to understand why your home insurance premium costs what it costs can be confusing - especially when it goes up and down. It's important to us that you know where your money is going no matter which insurer you’re with. So we've broken it down to make it as simple and clear as possible.

Claims: 50% to 90%

On average, between 50% and 90% of all premiums are paid out on claims. Paying claims is at the heart of what we do - that's the single reason you buy insurance, so you can be assured that when the worst happens we’ll be there for you.

Profit: -15% to 5%

Every business has to make a profit to exist - we're no different. But the profit we make is less than you might think. Andin the recent financial climate, many insurance companies aren’t making any profit at all.

Insurance Premium Tax: 12%

The Government adds 12% tax to your insurance premium, The tax is called Insurance Premium Tax, or IPT for short. Unfortunately, this is the one part of your premium we have no control over.

Expenses (including commission): 20% to 30%

It costs to keep the lights on. Like any business, expenses are necessary to keep us running. That's why some of your premium goes towards our employees' salaries and the cost of our offices, as well as investing in the most innovative technologies to make your experience with us as smooth and simple as possible.

Reinsurance / Industry Levies: 5% to 15%

Like all insurers, we pay into various industry funds that have been set up to protect you, the customer. For instance, the Financial Services Compensation Scheme protects you against an insurer going bust. Also, insurance providers back a scheme called Flood Re to help customers in high flood risk areas secure more affordable cover for their homes.

Reasons why your price could change

The cost of claims

It’s not just your own claims history that affects your home insurance premium. We pay millions of pounds every year to settle our customers’ claims – and that cost makes up the biggest chunk of what each person pays us to insure their home. Insurance companies absorb repair and replacement costs associated with a claim, and this can have an impact on your premium – for instance as home technology gets more expensive to replace.

Severe weather

Weather patterns are changing, and we’re seeing more floods and storm damage. So, to make sure we’re able to put right future weather-related claims, premiums could increase to cover the extra costs.

Insurance fraud

Unfortunately, it’s the innocent who end up paying the price for fraudulent claims. So, we’re working hard to update our fraud technology to stamp out fraud and stop this crime from hurting us all.

Taxes

Taxes to regulatory bodies and the government make up part of your price. Take Insurance Premium Tax (IPT) for example. If IPT goes up in future, this may impact your future premium when it’s time to renew.

New technology

Today’s homes are becoming more and more advanced every year. Items in and around the home are increasingly complex, and repairing or replacing them after a claim can be a lot more expensive. We’re constantly looking at the latest tech trends when we’re pricing policies.

Sometimes the changes you make to your policy can affect the cost of your premiums. Here’s more details about what policy changes can mean for your premium price:

Your new home

Moving home? Then you’ll need to update your home insurance. If you were upsizing, you’d probably expect to pay more for your insurance. Generally, the bigger the home, the more it will cost to insure. Older homes often have higher insurance costs too, as things are more likely to go wrong. And statistics show that detached homes are more at risk of burglary.

Your new address

Insurance premiums aren’t just based on the property and the people living there, postcodes are important too. Even buying a similar property a few streets away, could affect the price. Here’s some factors that could affect your price:

- Closeness to water sources, and how many homes have been affected by flooding

- Number of claims made in the area

- Crime and vandalism rates

High numbers of claims in your postcode, like flooding, may affect your premium. If you buy a property in an area where there are fewer claims made, your home insurance could cost less.

Your family and the people who live with you

More people indoors means more chance of damage being caused. So, it’s likely you’ll pay more for your home insurance if more people are in your home.. It’s important you always let us know any changes to who lives with you, so we can make sure the cover you have is right for you.

Your home improvements

If you’re making your property larger by adding an extension, this could change the rebuild cost, and it’s important to let us know. If the work completed has changed the number of rooms in your home, you can update this in your AXA Account. Making sure to check that the contents and buildings insured still meets your need.

Claims

Making a claim won’t affect the price of your insurance straightaway, but you may see an increase when it’s time to renew. As you would expect, people with fewer or no claims tend to pay less for their home insurance.