What is business insurance?

Business insurance (sometimes referred to as "commercial insurance" or "company insurance") is a term that describes the insurance policy that protects your business. It usually consists of a combination of four standard covers and any optional extras that provide cover for something that isn’t included under your standard cover.

Depending on the policies you buy, you'll protect your business against compensation claims made by:

Business insurance is much more flexible than other insurance types. It needs to be customisable to fit a wide range of different business types, and different occupations will need different cover.

Whether you’re a self-employed consultant working from home, a retailer with your own store, a professional working in an office, or a tradesperson out on the job-site - everyone needs different protection from different risks.

To get the right cover for your business, you'll need to consider the unique risks of your occupation and compare with the different types of business insurance available.

What can I cover under business insurance?

Most business insurance policies will include one or a combination of the following covers:

Public Liability Insurance

What it covers: Your legal liability for paying compensation and any legal fees if your business causes accidental damage or injury to a third party.

Who needs it: Businesses who interreact with members of the public, either on their own premises like a shop or an office or at a job site, such as a customer’s home or public area.

Example of a claim: A painter and decorator are working in a clients home and a can of paint is accidentally tipped over. The customer's expensive rug and wood floor is ruined. The customer holds the decorator liable for the damage. In this example, public liability insurance would pay to cover the cost of repairing the damaged flooring and replacing the rug.

Is it a legal requirement: No, there is no legal requirement to hold a public liability insurance policy in the UK. However, some customers may ask you to have a certain level of public liability insurance in place as part of a contract. This is especially true for businesses who regularly work with public bodies like councils.

Coverage Limits: £1 Million to £10 million (depending on your occupation)

Interested in Public Liability Insurance? Find out more.

Employers’ Liability Insurance

What it covers: The cost of paying compensation and any legal fees if a member of your staff get injured or fall ill as a result of working for you.

Who needs it: Any business with staff of any kind. That includes temporary workers, contractors or volunteers. It even includes family and friends "lending a hand" on a temporary basis.

Example of a claim: A builder has hired a temporary worker to help finish a big job. While on-the-job, the temporary worker trips on some loose cables and injures their wrist. The temporary worker holds the builder who hired them liable for the accident and decides to sue for the months of lost work they'll experience because of the injury. In this example, employers’ liability insurance would cover the cost of paying the workers compensation.

Is it a legal requirement: Yes, in the UK it is a legal requirement to have an employers’ liability insurance policy in place if you have any staff. Including volunteers or temporary workers.

Coverage Limits: £10 million as standard.

Interested in Employers' Liability Insurance? Find out more.

Professional Indemnity Insurance

What it covers: The cost of paying compensation and any legal fees if professional advice you've given result leads to a financial loss for client, or if you’ve provided negligent services to a client.

For example, breach of confidentiality, defamation, breach of copyright, loss of documents and breach of professional duty are all covered as part of your professional indemnity policy.

Who needs it: Any business who carries out professional services or offers advice to clients. This includes, for example, consultants, accountants etc.

Example of a claim: A graphic designer sends the wrong dimensions to the printing service and the client is charged for posters they won't be able to use. In this example the graphic designer would be covered for the cost of compensating the client for the posters.

Is it a legal requirement: No professional indemnity insurance is not a legal requirement in the UK. However, many accredited professional or licensing bodies will ask that you have a professional indemnity insurance policy in place as a condition of membership.

Coverage Limits: £100,000 to £5 million.

Interested in Professional Indemnity Insurance? Find out more.

Business Contents Insurance

What it covers: The cost of replacing lost, damaged or stolen contents from your shop, office or similar brick-and-mortar business premises. This includes theft of takings from a till or safe.

Who needs it: Businesses with contents or stock – whether this is from a physical premises or working from home. Some of the most common business who take this cover are: cafes, restaurants, shops, offices or beauty/ hair salons. You may also want to consider this cover if you have a workshop for your business as it will cover any content stored within.

Freelancers can also benefit from this type of cover - especially if you have equipment that is vital to your role. Photographers are a great example of the types of freelancers that could benefit from this cover.

Example of a claim: A tailor shop experiences a burst pipe and the flood damages customer's belongings in for repair as well as a host of high-end suits that were displayed for sale. In this example, business contents insurance would cover the cost of replacing the damaged stock and public liability insurance would cover the cost of compensating the customers whose belongings were destroyed.

Is it a legal requirement: No there is no legal requirement have a business contents insurance policy in place. However, it is a cover that might be required for hire purchases or if you’re a mortgagor.

Also, if you have a lot of equipment, fittings or handle a lot of cash, business contents insurance can offer peace of mind should anything go wrong.

Coverage Limits: Varies depending on the contents being covered.

Interested in Business Contents Insurance? Find out more.

What other cover can I get?

Alongside one of the four core covers, most insurers offer a host of optional add-ons. These offer additional protection and help you tailor your policy to the unique needs of your profession.

Tool insurance

Standard policies cover repairing and replacing your own tools if they are lost, stolen or damaged.

Hired-in tools

If you need to hire tools from a third party to complete a job, then Hired-in plant cover will cover the cost of replacing or repairing these tools if they are damaged in your care.

Business equipment

Covers suited to professionals which covers moveable items used in connection with your business. This includes work tech, like mobiles, tablets and laptops as well as specialist equipment like cameras.

Workshops

Cover specifically designed for protecting the contents of a workshop or store on your business premises from damage or theft. Typically, workshops cover protects tradespeople storing tools.

Contract Works Cover

A specialist insurance type for builders who specialise in new buildings or adding extension to an existing building. This add-on will cover you against the cost of labour and materials if the structure is damaged while you're still working on it.

Business interruption

Cover against lost income if your business is unable to trade following a major disruption such as a fire, flood, storms or the failure of the public supply of gas, water, or electricity.

Legal expenses

Cover for any expenses associated with handling a legal dispute in connection with your business. This includes hiring a solicitor, legal fees, court fees and compensation costs.

Who needs business insurance?

Most businesses need some insurance. The type of business insurance you need, and the nature of the risks you face varies between professions. For instance, the risk faced by a full-time hairdresser is different to the risks faced by an enthusiast selling their handmade crafts online. But across most professions, everyone needs some level of cover:

Freelancers, Sole Traders and the Self Employed

For freelancers or sole traders who work at home, the risk of claims from the public is lower, and the likelihood of having employees is lower so professional indemnity may be the key consideration for this group. However, it's important to consider the specifics of your own role when deciding on the right cover.

Limited Companies

Limited companies are more likely to have employees, so employee liability insurance is a legal requirement. Other cover is dependent on the nature of the work you do. If you’re regularly interacting with the public, public liability insurance will protect the business against claims made by third-parties.

Trades

Tradespeople are exposed to high levels of risk. Many tradespeople invest in public liability and some contracts may ask that you have this policy in place as a requirement. Professional indemnity is also a key consideration if you offer your clients advice and employers liability is a legal requirement if you have staff of any kind. In terms of optional add-ons, tools insurance can offer valuable protection for tradespeople.

Consultants

Professional indemnity is one of the most important insurance considerations for consultants. The nature of your role means you’re always offering advice and services for clients that could result in a material loss. Public liability will also protect you if you’re regularly working around clients or members of the public.

Shops

Retail spaces of any kind, from gift shops to hair salons, are also higher risk than many businesses. The likelihood that you have staff is much higher and that means that your legally required to have an employer’s liability policy.

Your also dealing with the public all day, every day so public liability insurance is another important consideration. With this, you’ll also be automatically covered by products liability as standard, which means that you’re covered if someone gets injured because of your product.

Finally, the fixtures, fittings, stock and equipment you need to run your shop are also at risk of damage. Contents insurance can protect these.

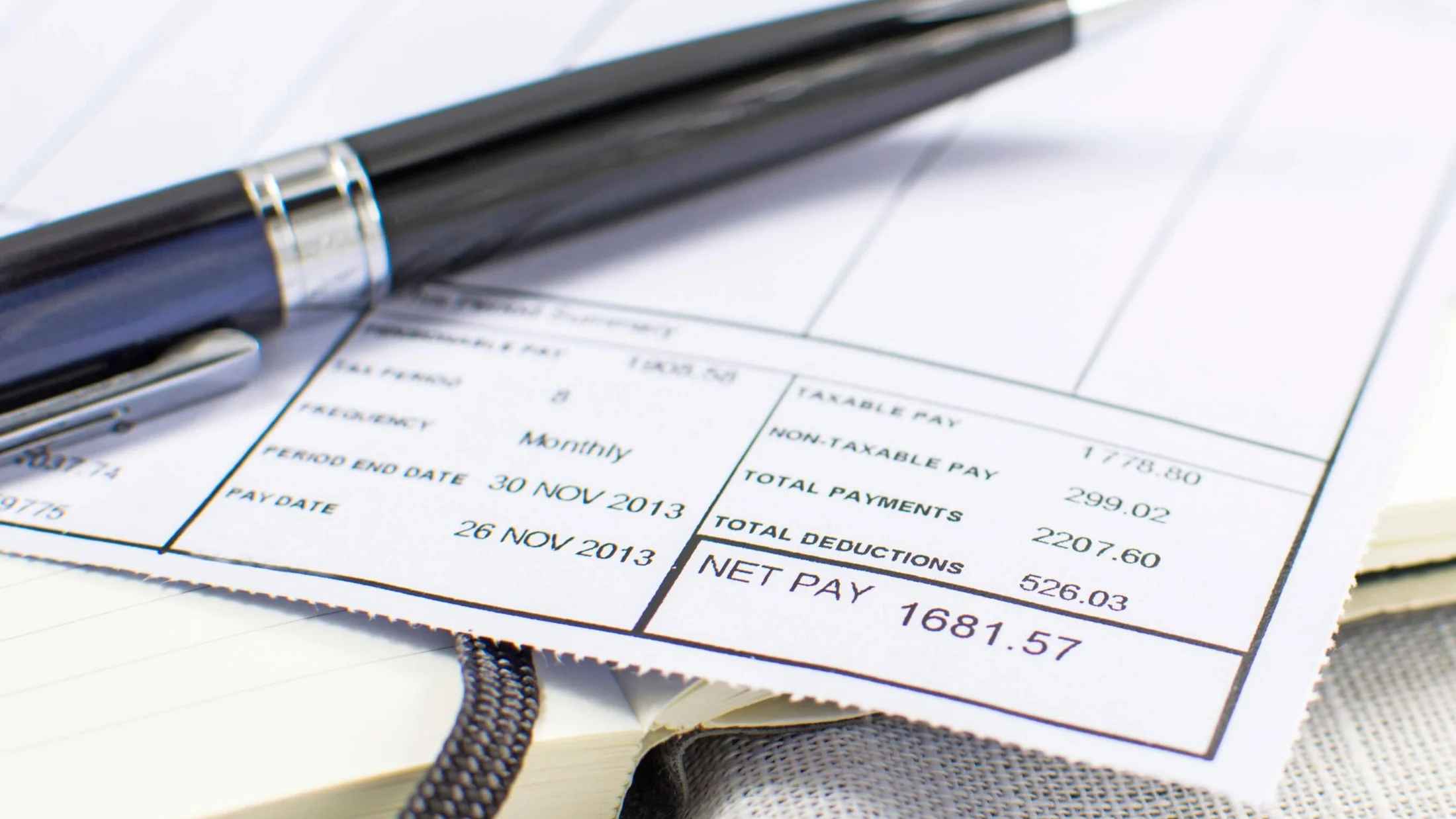

How much does business insurance cost in the UK?

AXA customers pay from £79** a year for business insurance. However, the cost of business insurance varies depending on the products and optional extras you choose.

It also depends on other factors, such as:

Your profession - what your business does helps insurers estimate the risk of a claim. If you are in an industry that is more likely to claim, work in dangerous environments or with dangerous tools and materials, then the price you pay will be higher.

Your location - if you are in an area with a history of claims, then you might pay more for your business insurance as a result.

Number of covers - if you have greater protection by holding a number of covers, you will likely pay more overall.

Your coverage limits - each cover comes with a different coverage limit. This coverage limit determines the maximum insurance pay-out you'll receive following a successful claim. Policies with lower coverage limits are typically cheaper but could leave you underinsured. It's important to conduct a risk assessment for your business and get the right level of cover for you.

The value of your contents - the value of your fixtures, fittings and the value of your goods/stock will all be considered when you get a price for a business contents insurance policy.

Your staff - the number of employees you have will influence the cost of your employer’s liability insurance policy. More staff will come with more risk of something going wrong and this will be factored into the price of your policy.

The key to managing the cost of your business insurance policy is taking measures to reduce the risk you are exposed to. Conduct regular risk assessments and reduce risky business practices where possible.

If you want to find out the exact cost of your business insurance policy, it's best to get an online quote.

GET A QUOTEIs Business Insurance a Legal Requirement?

In the UK it's a legal requirement to have employers’ liability insurance if you have any staff whatsoever. For more information consult Employers’ Liability (Compulsory Insurance) Act 1969. All other polices, including public liability, professional indemnity, employers’ liability and contents insurance are optional but offer important protection. They may also be required as part of contractual agreements with clients and suppliers.

How do I get a business insurance quote?

To get a business insurance quote, you need some basic information about your business including:

Business name and address - It's okay if you’re not a registered yet, you just need the address your business correspondence is sent to and your trading name

Type of business - Whether you’re a sole trader, a limited company or in a business partnership

Details of any additional occupations you’d like to cover as we can offer dual trades

How many, if any, employees you have

Some basic business information - such as annual turnover and projected revenue

Information about any previous claims - relating specifically to your business

Ready to get started?

GET A QUOTEWhat happens when I make a business insurance claim?

Making a business insurance claim can be broken down into three main steps:

- Before you make a claim

Before you make a claim it's important that you do what you can to stop any more loss or damage. It's also essential to contact the police immediately if you believe the incident has been caused by a malicious third-party.

It's also a good chance to check your policy documentation to make sure your covered for the incident you are about to claim for.

- Gathering the information

When you make a claim, it can make things less stressful to get the following details in order before you contact your insurance provider.

Your personal details and your policy number

The details about the incident, including when and where it happened and any supporting evidence including photographs

The crime reference number and police report, if the claim is related to criminal activity that you've had to report to the police

- Making contact regarding your claim

Once you've got your information together get in touch and tell your insurer about the claim. They'll talk you through the next steps and any further information you need to provide.

Why choose AXA Business Insurance?

867k

We protect over 867,000 businesses like yours2

4.6/5 stars

Rated by 16,964 customers on Feefo3

More AXA insurance products

Business insurance FAQs

Could you be one of AXA’s next Startup Angel winners?

AXA Startup Angel gives you the chance to turn your business dreams into a reality and set your business up for success.

Our customers say...

Our customers’ reviews, independently moderated and managed by feefo. Based on 0 total reviews.

.

*10% of our customers paid from £7.00 for ten months between January and March 2025 after an initial deposit. Interest applicable. For more details see our terms & conditions.

**10% of our customers paid this or less between January and March 2025.