How to price a product

How to price a product

Deciding how much to charge your customers is one of the most important decisions you’ll make in business. If you’re too cheap, your profits will suffer and people might assume your product is of poor quality. But if your prices are too high, you run the risk of putting people off completely.

Whether you’re new to business and not sure where to start when it comes to pricing, or you’ve been self-employed for a while and you think your prices could do with a re-fresh, AXA is here to help. In this guide we’ll explain how to price a product so you can maximise profits while still being competitive and attractive to customers.

A step-by-step guide to pricing

Here, we’ll show you the ‘cost-plus’ pricing technique, which is a common pricing strategy for small businesses. It’s a fairly straightforward process that involves working out the break-even cost of your product and adding a ‘mark-up’ percentage. This method will give you the minimum amount you need to charge to cover your costs and still make a profit.

Follow these three steps to calculate a sustainable price for your product or service.

1. Know the market

Before you can think about putting a price on something, you’ll need to understand how much your customers are willing to pay. To do this, you should to do some competitor research and find out how much they’re charging. However, simply matching your competitor’s prices isn’t always an accurate pricing strategy because you don’t know what their overheads are and you could be offering a lower or higher-quality product than they are.

Top tip: Be realistic about who your competitors are. You need to consider their capabilities and how likely you are to be directly competing against them for business. For example, if you’re an independent candle retailer, you might not want to choose Yankee or Jo Malone as direct competitors.

2. Calculate your costs

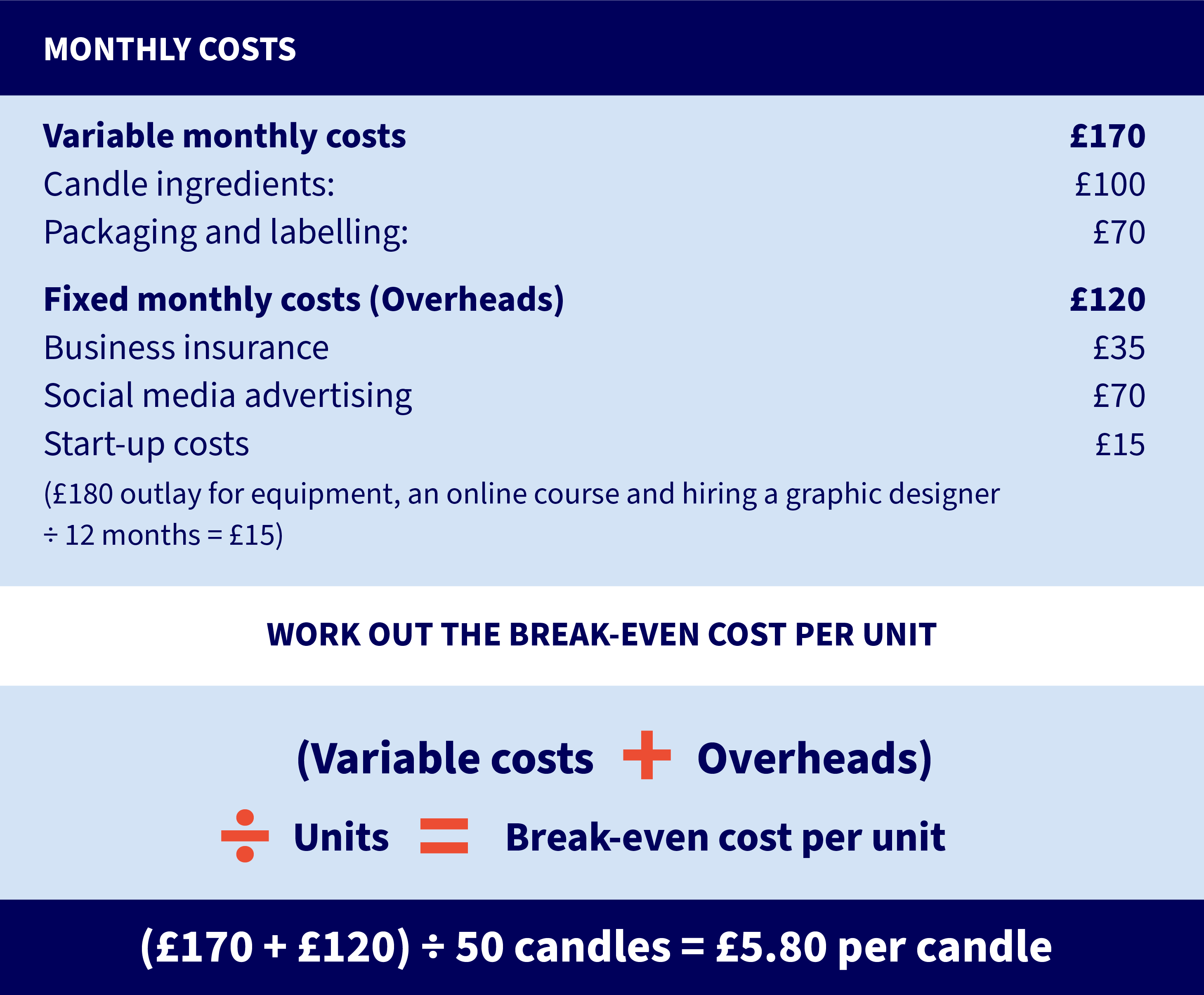

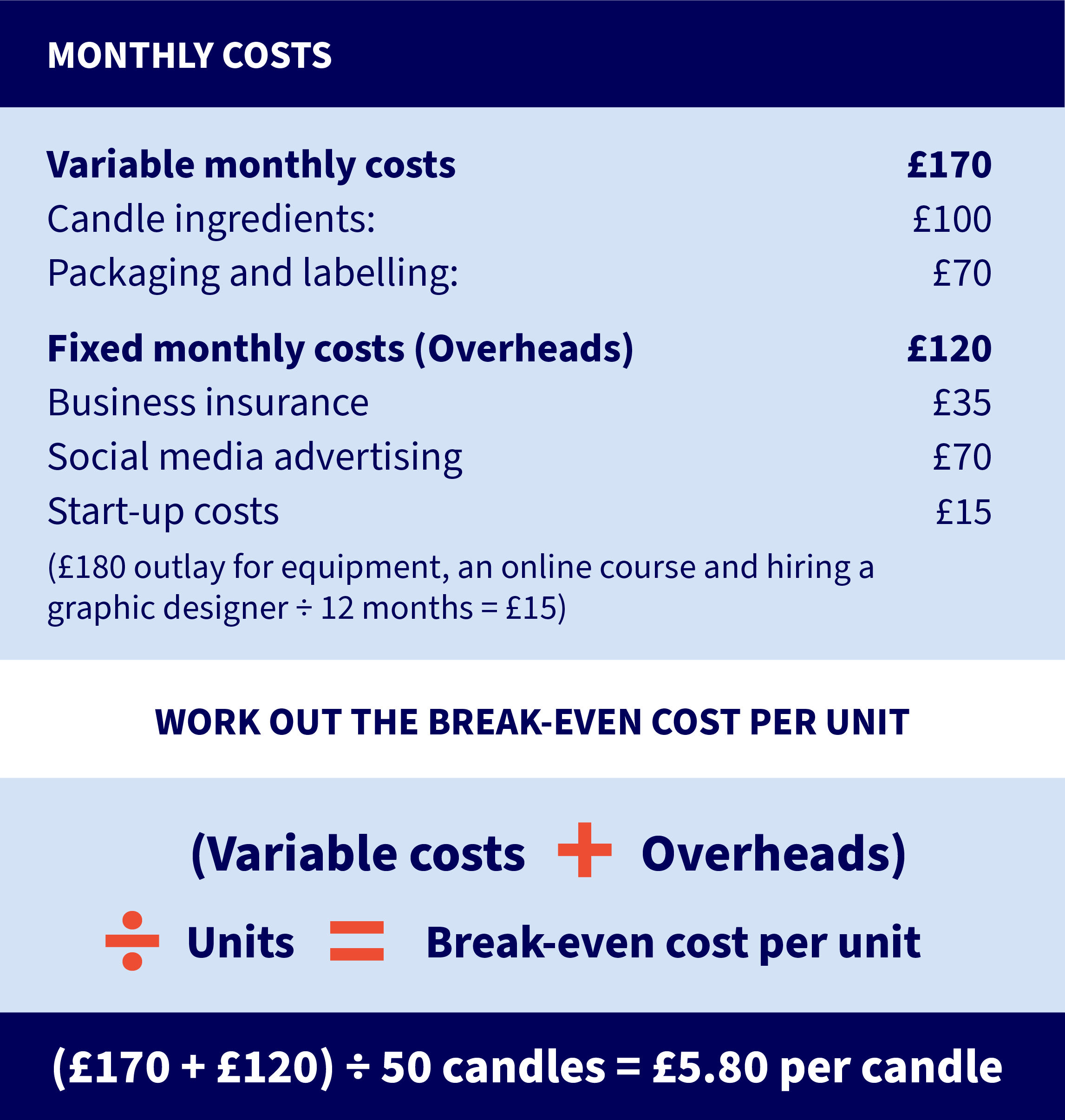

It’s good to know the market and understand what your competitors are doing. But if you don’t know how exactly much it costs to bring your product to market, you might not earn enough to sustain your business.

To understand how much to charge your customers, you need to know your ‘break-even’ figure. Or in other words, the amount you need to charge to simply cover your costs without making any money. To calculate the break-even figure, you’ll need to look at your variable costs and your overheads.

Variable costs: The costs of things like supplies, materials and packaging which will change depending on how much you buy and sell.

Fixed costs (Overheads): The money you spend on things like rent, insurances, vehicle finance and wages. Overheads are sometimes referred to as ‘fixed costs’ because you pay the same amount each time.

Most people list their expenses as monthly or weekly amounts, unless you’re working at an event with a shorter time frame, for example catering at a two-day music festival or a one-day pop-up shop. To work out your break-even cost per unit, add all your costs together and divide it by the number of units you have.

The calculations will look something like this.

Variable costs + Overheads = Direct cost of sales

Direct cost of sales ÷ Units = Break-even cost per unit

3. Add in your profit

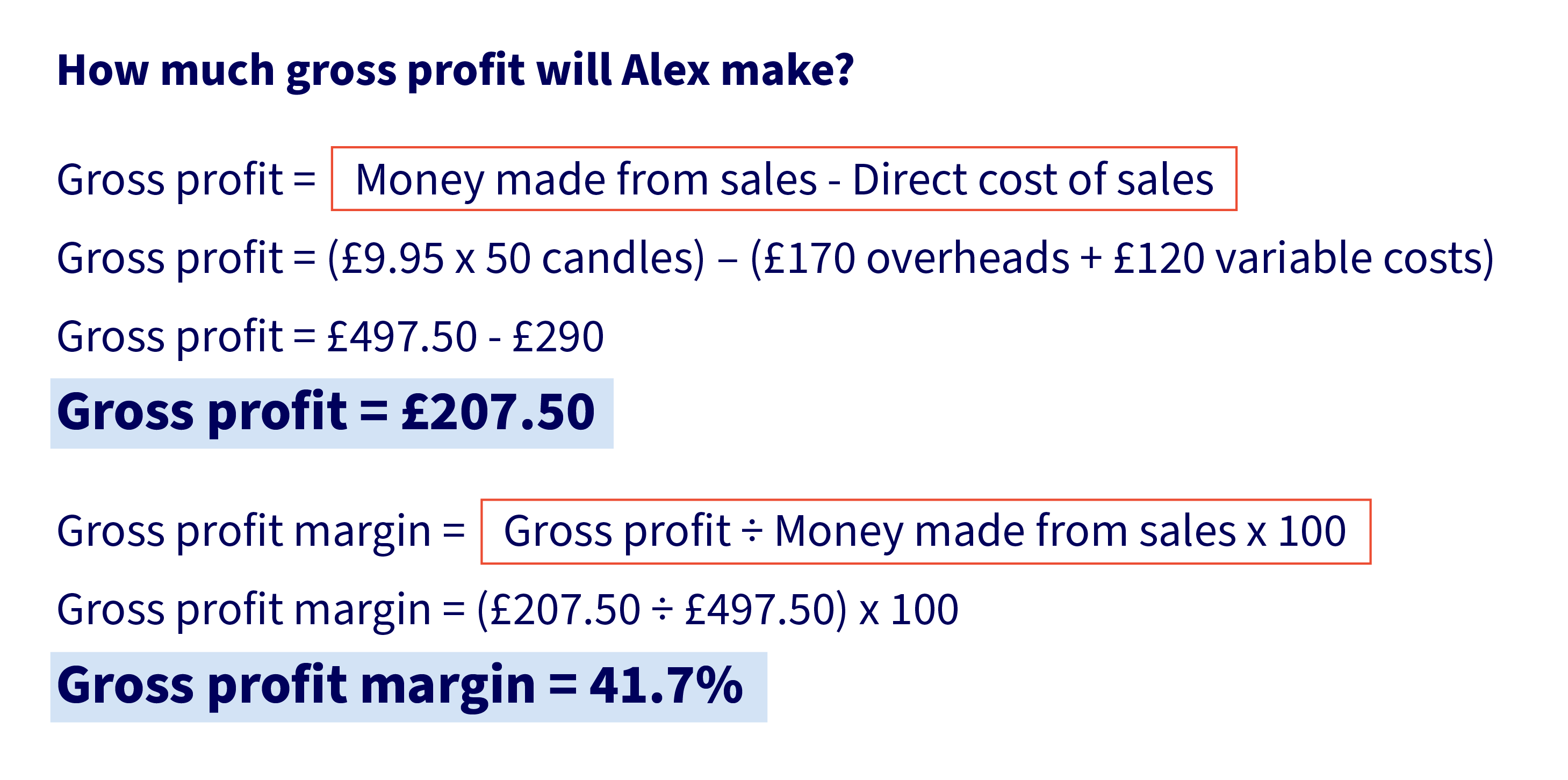

After calculating all your costs, you’ll know how much you need to charge to break-even. Next, you’ll want to add a ‘mark-up percentage’ to make sure your business makes a profit. Your market research will help you decide the level of mark-up, but you should also consider who your target customers are and how much they’d be willing to pay.

Mark-up is essentially the difference between the cost-price and the selling price. A mark-up percentage commonly ranges anywhere between 10% and 50%, but it can be as much as 200% depending on the industry or service provided. The higher mark-up percentage, the more profit you’ll make.

Watch out: The cost-plus pricing method works on the assumption you’ll sell all units. If you don't, your profit is lower.

Gross profit margin calculator

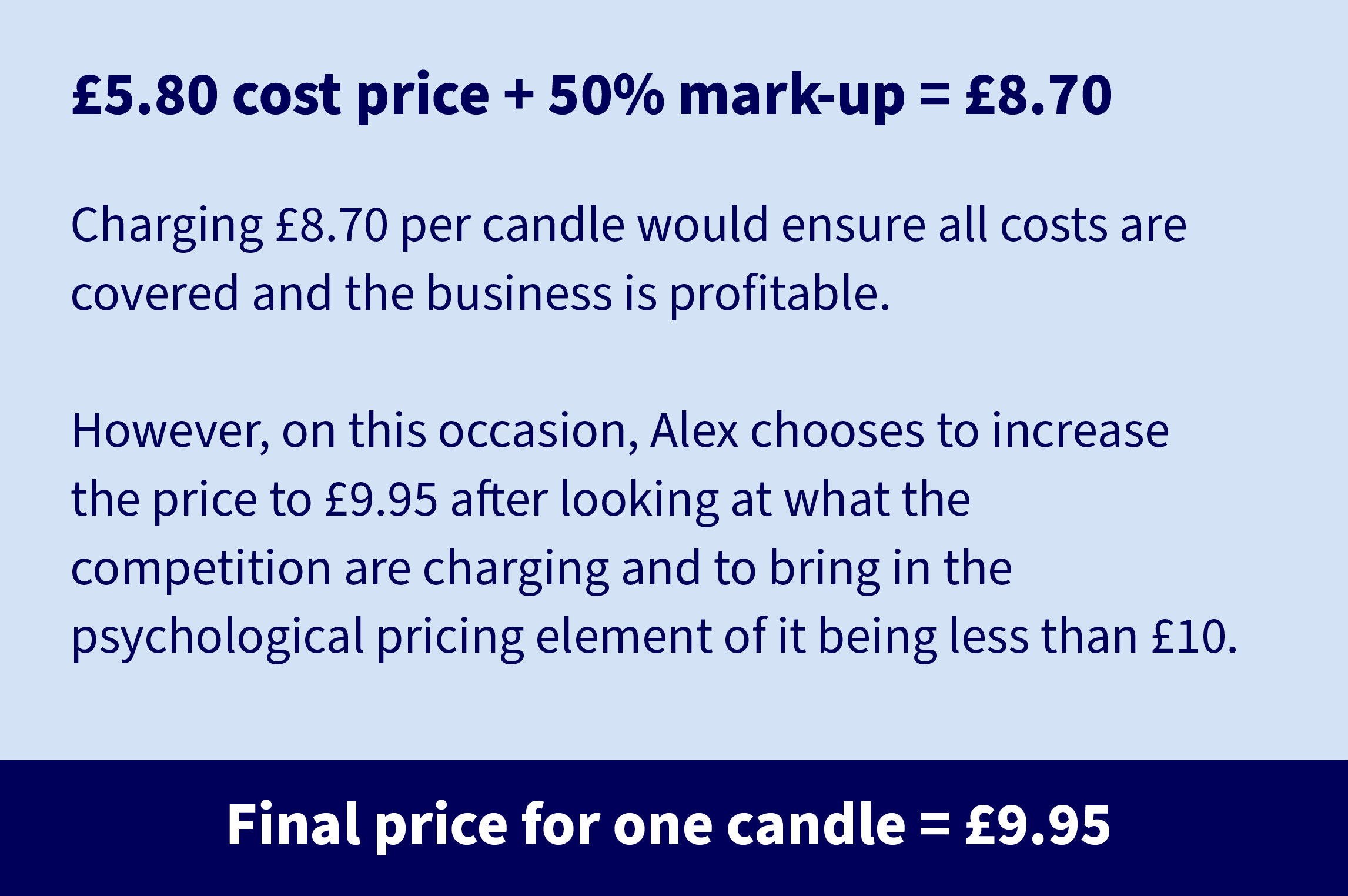

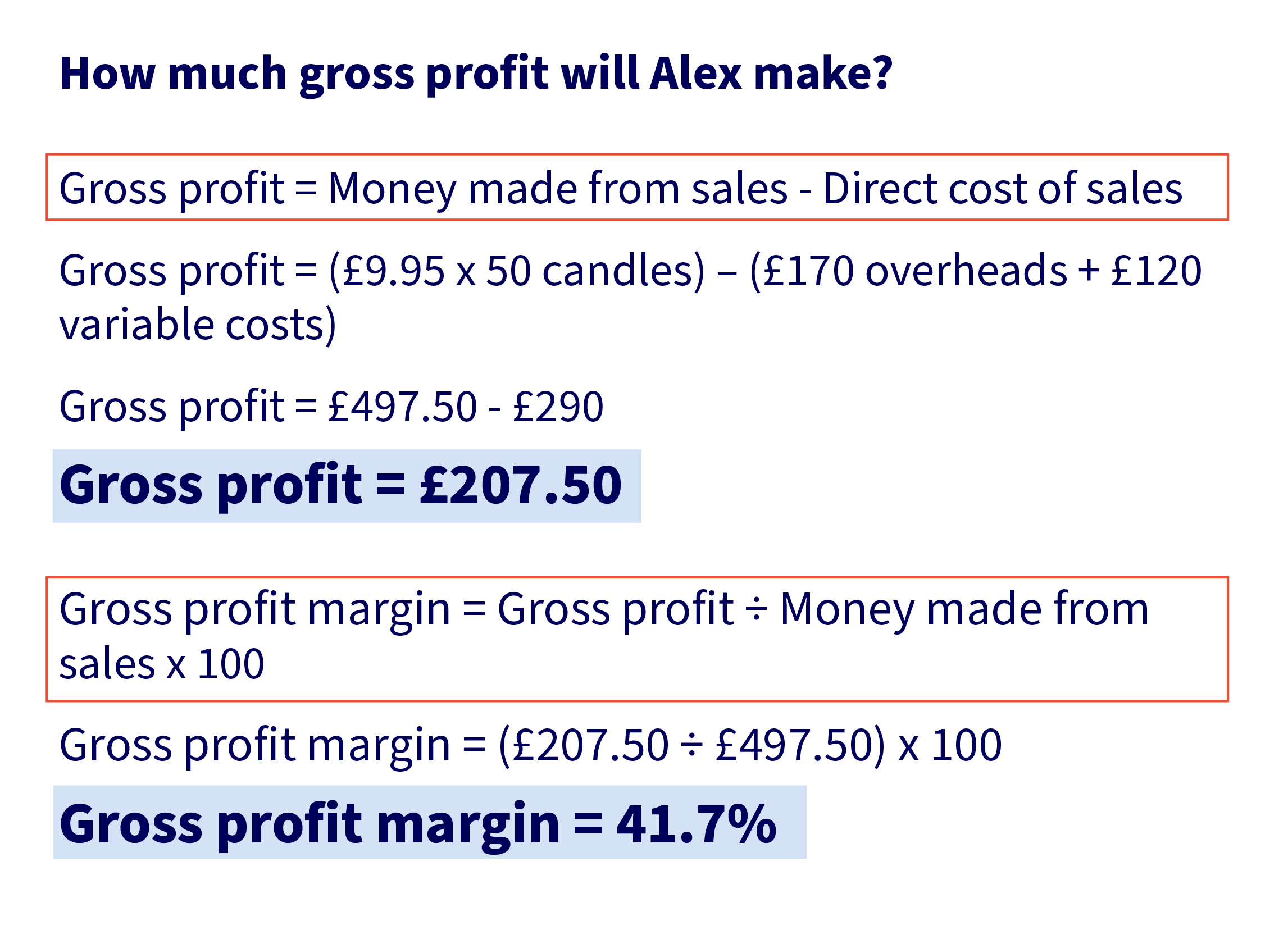

When you’re adding in your profit using the cost-plus pricing method, here’s how you can calculate the gross profit and gross profit margin. Just use these simple calculations to work out the gross profit and gross profit margin:

Gross profit = Money made from sales - Direct cost of sales

Gross profit margin = (Gross profit ÷ Money made from sales) x 100

Different types of pricing strategies

Cost-plus pricing is all about the minimum amount you need to charge to cover your costs and still make a profit. However, there are many other pricing strategies and techniques you can adopt to make your product appear more attractive to customers. Here are some of the other common pricing strategies:

Value based

This pricing strategy is about the perceived value of a product rather than the actual value. For example, you might be able to charge more if you’re the only drinks stall at an outdoor event on a hot day. Or, a handbag might be more expensive because it’s sold by a famous designer, not because it uses expensive materials.

Milking

Sometimes known as ‘price skimming’, this involves charging a higher price initially and then slowly lowering the price to make the product available to a wider market. Therefore, ‘milking’ the profits from each market layer by layer.

Premium

A premium pricing strategy is when you charge a higher price to reflect the quality or exclusivity of a product.

Competition

When you position your prices based on what your competitors are charging. This could mean you charge the same as them or set your prices slightly lower.

Penetration

This pricing technique involves setting a low price initially to attract customers and boost sales. Then, when you’ve established a customer base and have a good market share, you can put your prices up.

Bundling

Offering a discount when customers purchase more than one product can be a great way to drive sales and promote customer loyalty.

Psychological

The psychology of pricing is all about making a product appear cheaper than it is. For example, £4.95 appears much cheaper than £5.05 despite there only being a small difference between the two. However, other evidence suggests that round numbers can be perceived as more trustworthy and represent high quality.

Optional extras

Offering optional ‘free’ extras along with your product can entice customers and maximise revenue. For example, offering a free wax melt if a customer buys a candle.

Example

Alex has recently started a business selling luxury candles. Running the business from home and selling through social media, Alex plans to produce and sell 50 candles every month.

When deciding how much to charge customers, Alex worked our exactly how much it cost to produce one candle. To do this, Alex considered the expenses associated with running a business as well as the cost of producing the candle itself.

Alex used the cost-plus pricing strategy as a starting point and then looked at other pricing techniques to decide the final price.

![]()

Step 1

Know the market

![]()

Step 2

Calculate the costs

![]()

Step 3

Add in your profit

Know the market

Alex carried out extensive market research on social media, online forums and through direct customer feedback. From this, Alex discovered that her main competitors were charging between £8 - £20 for a comparable product.

Calculate the costs

Add your profit

The market research findings mean Alex adds a 50% mark-up to the candles

Setting the price of your product is one of the most important decision you’ll make when you’re starting out or launching a new product. However, just because you’ve set your product at a particular price, doesn’t mean you need to stick to it forever. If you get customer feedback that suggests your pricing isn’t quite right, you can always change it to a price that works better.

Protection for your employees is a few clicks away

Life’s too short to get bogged down by complex insurance jargon – your time’s better spent running your business. That’s why we’re doing all we can to make insurance easier. Get an employers’ liability quote from as little as £52* with AXA.

10% of our customers paid this or less between July and September.