Business credit score: what it is & how to improve it

Business credit score: what it is & how to improve it

For startup founders, there's so many tasks to balance that it can be easy for things to fall through the cracks. However, establishing business credit shouldn't be one of them.

SME Loans statistics showed that between June and July of 2021, there was around a 17% increase in businesses interested in using a credit score tool – this is likely because the pandemic put a financial strain on many businesses who then needed loans to help them stay afloat.

In fact, data from HM Treasury showed that in just a 4-month period last year, more than 1.4 million applications were made to the Coronavirus Business Interruption Loan Scheme (CBILS) but only about 50% of them were approved. Without a strong business credit score, help from loans is unlikely to come and when things get tough, you don't want to be one of the applicants who gets rejected.

Find out more about the ins and outs of a business credit score, why it matters and how to check yours in our guide.

What is a business credit score?

Business credit scores are, in principle, very similar to your personal credit score. They're both used to help a variety of lenders such as banks or investors decide whether or not to do business with you. However, they're measured on different scales and a business credit score report will be publicly available for customers, suppliers and other businesses to check.

A business credit report provides you with a comprehensive picture of your company's financial standing and can cover details such as ownership information, subsidiary companies, credit inquiries, personal loans, missed payments, risk scores and any liabilities or bankruptcies. Credit reporting agencies start building a business credit record on your company from the moment you start your business bank accounts.

With that information readily available to anyone, it can affect:

How much you can borrow

Whether you’ll be approved for a loan at all

Less clout in contract negotiations

Whether or not qualified investors are interested in your business

Your interest rate

Whether or not partner companies will extend your contracts

The cost of business insurance

Without a credit history, lenders won't know if your company is safe to lend to or not. If they can't feel certain that your company can pay back the money, they're unlikely to lend to you. Don't wait until you're looking for credit to start thinking about your business credit score.

Instead you should establish it early and monitor it regularly. Doing this can unlock several key benefits for your company such as lower interest rates, better insurance premiums, and keeping your business finances separate from your personal finances. Until business credit is established, some lenders may ask that you personally guarantee some debts, but a score typically eliminates that request. Of course, this is only relevant if your company is an LLC, as a sole trader your personal credit scores will act as your business score since there's no separation between you and your business.

In addition to increasing the likelihood of being able to take out loans, a good business score may also help you attract new investors and partners that'll help your business grow and scale over time. This can expand the amount of financing options available to your startup and help get you through the unexpected rough patches.

Given that the score can impact so many different aspects of your business, it's vital that you stay on top of it to give your company the best chances of success.

How can I check my score?

There are quite a few credit rating agencies (CRA) in the UK including Experian, Equifax, TransUnion, Credit Safe, and Dunn and Bradsheet. Before deciding which to use, take a look at what they offer – for example they may not all have an online service so if you're trying to keep business documents digital, one which does have online reports will be a better choice for you.

Once you've decided which CRA you want to use, you'll get in touch with them and request the file. It's as simple as that. You may want to get the report as one off or possibly sign up for a subscription model so that you can regularly review your business credit report without it having a negative effect on your score.

What is a good business credit score?

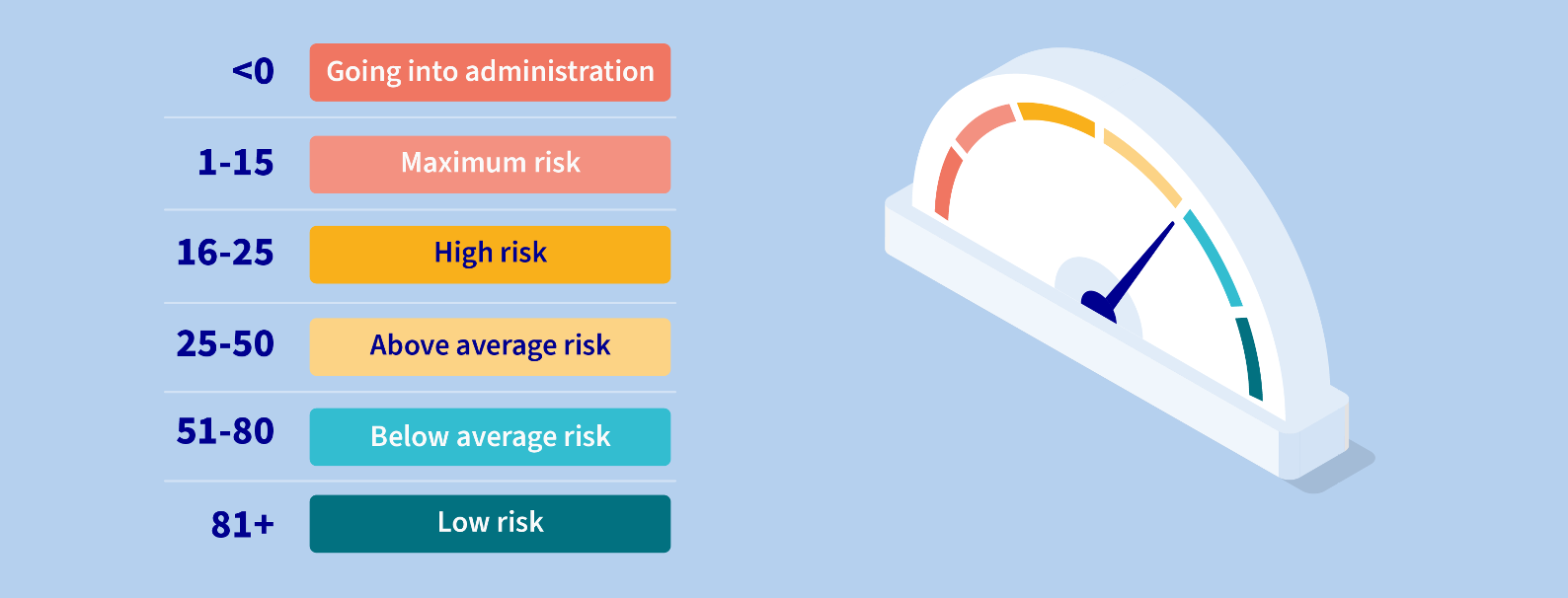

Often, personal credit scores range between 300 and 850, but business credit scores are usually done on a 0 to 100 scale. At its most detailed, you could look at scores like this:

A high credit score shows that your company is likely to repay any debts you incur and that you'll do it on time. A low credit score can signal that you often pay late or don't pay at all.

As a general rule of thumb, above 80 is the range you want to be in and below 50 is where you may start to worry about the score impacting your lending ability. Between that, you're not a major red flag but there's certainly room for improvement.

How is a business credit score calculated?

When a credit report is requested, the credit reporting agency will look into many different factors of your business in order to create your business credit score. It's important to note that each agency will have a slightly different way of calculating scores, so your rating may vary depending on which agency you ask to carry out a report.

Though there's no exact list of factors that contribute to your score, here's a look at a few things a credit reporting agency may look at when calculating your business credit score:

The ownership details for the business

Any trade credit secured

Amount of existing credit available to your company

Your credit providers

Your credit history

Your industry risk

Past repayment history if your business has borrowed before

The number of times you’ve applied for credit in the past

Whether you file your business accounts on time (if this applies)

The company accounts

How many applications for finance you’ve made in the past

Whether your business is registered with Companies House or not

Information the Registry Trust holds on you such as any County Court Judgements (CCJs)

Size and age of your business

Business location

Number of past applications for finance (and whether you were successful or denied)

Whether you’ve exceeded overdraft limits

Keeping an eye on your credit score

Experian estimates that almost two-thirds of business owners have never checked their credit score. While this statistic isn't necessarily surprising, if you're one of the one-third that does check your business credits core, you'll find yourself ahead of the game:

Credit scores change

Business credit scores are ever-changing, so it's not something you can look at once and be done with. By consistently monitoring your score, you'll be able to ensure that your business stays in the low risk zone and be able to make smarter business decisions.

Future proof your business

By knowing what your score is and maintaining it at a good level, you're future proofing your business. This will ensure that financing options are available to you should the business unexpectedly have hard times. You'll also be alerted if potential partners request to check your credit information. This may signal to you that they’re a partner who does their due diligence and that you might feel comfortable doing business with another company that is so thorough.

You can see a true representation of your business reputation

Looking at your credit report will allow you to look at your business from the perspective of a potential customer, supplier, distributor or investor. While you may have your own pitch for these stakeholders, they're likely to look at your credit score as a third-party and impartial judge of your business. Understanding how you look from that perspective can help you prepare better for speaking to new partners and answering any questions they may have.

How you can improve your business credit score

There's no quick fix for low credit scores but taking there are some actions that are known to be helpful for people looking to improve their credit score. Here's a few ideas if you're looking to build up a healthy credit score for your business:

Getting organised so that your payments and filing all happen on time is one of the simplest ways to start working towards a good credit score. This applies to electricity and heating bills, credit repayments, fines and any other fees that you can think of. Even if you use a flexible financing option such as trade credit or net terms, remember that these are still a form of credit and must be paid in a punctual manner as well.

Beyond payments, there's also paperwork. Submitting your accounts to the Companies House and filing your returns on time can also help keep your score in line. Late or inaccurate paperwork can make it seem like your struggling or hiding something.

If information about your company varies from place to place, it can make your business look less credible to lenders. Any time there's an update to key information such as your business status, contact details, or company location you should ensure that all relevant parties are clued up on that information. That can include official bodies such as the Companies House as well as your company contacts such as suppliers and customers. Consistency of information creates a more reliable impression of your company.

If you're regularly keeping track of your credit score, it should be easy to recognise when something doesn't look quite right. Inaccuracies may be due to simple errors or could be something more complicated such as fraud. Unfortunately, fraud has been on the rise in the UK during the pandemic with April 2020 showing a 33% increase in the rate of fraud compared to the average of previous months.

Luckily if you're having issues with any sort of discrepancy, it's easy to report them. Get in touch with one of the main CRAs as soon as you notice a problem. They'll likely ask you to prove that their information is incorrect, so prepare any relevant evidence that can help your cause. If your evidence is deemed sufficient, they then will adjust the reports accordingly.

Once your business is established, you should open a business bank account in your business' name and possibly consider opening a business credit card. Not only will this help with establishing credit that belongs to your business but also it will make admin tasks such as claiming allowable expenses easier if all your businesses expenses are on one bank account.

If you have multiple business accounts, you may want to consider consolidating them. Having a lot of credit available in multiple accounts makes it look like you're planning to spend a lot more than you have and may not be able to make all your repayments. It's all about balance – having and using some credit is good but too much can look suspicious.

If you make too many credit applications in a short period of time, it can make your business look like it's desperate for credit and your record gets updated every time you apply for credit. All those applications will show up on your business credit report and may cause partners or stake holders to think that something is amiss. It may imply that you've either been rejected repeatedly or your planning to take money from many lenders at once – neither option is particularly reassuring to anyone looking at your report.

If you need to apply for business finance, but are afraid that you may be rejected, ask for a ‘quotation’ instead from possible lenders. This can help avoid having an official hard check on your credit score.

A credit utilisation ratio is the amount of credit you're currently using divided by the total amount of credit you have available. Forbes recommends keeping your business credit card utilisation below 30% to show that you're not relying too much on credit. You can bring this ratio down by paying off your balances, spending less on credit, or increasing your credit limit..

A County Court Judgement (CCJ) is a type of court order that might be registered against you if you fail to repay money you owe, and they get reported on your credit report. Obviously, this is something you would look to avoid having on your credit record and should you get one, you should try to resolve it as quickly as possible.

We'll go a little deeper into how and when business and personal credit scored can be connected, but for startups or very small businesses with less than three directors, lenders may investigate your personal credit score as well. As such, it's important that your personal credit score is in a good place and that you're keeping up to date with it as well.

While your partners credit score won't affect yours directly (ie a credit report isn't going to dive into everyone you do business with), the failure of a key partner could still have a serious negative impact on your business. Before signing a contract, you should look into credit reports for various buyers and suppliers that you work with to make sure they're not on the verge of administration or anything else that could damage your business.

When you're deciding which CRA to use, you might want to see which offer recommendations. While it's not standard to have this included on your credit report, some CRAs do offer suggestions for ways to improve your score. Getting that information straight from the agency that made your calculation is an invaluable source of information and would help you pinpoint what to address first.

Checking the scores of business partners

While we've mostly talked about understanding your own business' credit score and why you should stay on top of it, it's also important to understand how business scores can help you head off major issues with partners before they happen.

If you're in the midst of negotiating contracts with a partner, you may want to check out their credit score before signing on the dotted line and here's a few reasons why:

Fraud is a pervasive issue

Given the level of detail that a credit report goes into, you'll be able to check that any information they've submitted to the Companies House matches what you're being told now. If you struggle to find any information on them, then proceed with caution.

Cash flow problems for a partnering business can hurt you too

If you're relying on cash coming in from a customer, you'll want to know if they typically pay on time or if they're consistently late. Understanding their payment behaviour can help you plan better for managing your own cashflow or may help you decide that a business isn't the right partner for you after all.

Supply chain breakdown could cause major business disruption

Carrying out a credit check on the different companies in your supply chain will help you ensure that they're all financially stable and that the chain isn't going to collapse. If you didn't check and a major supplier went out of business unexpectedly, that could leave your company unable to function and ultimately cost you your business as well.

How personal credit affects business credit scores

If you're a well-established company, it's not likely that CRAs will look at your personal credit score when considering lending to your business. However, if you're a start up with a very limited business credit history or you're a sole trader, your personal credit score could matter.

If you're a sole trader, your personal credit score will always be the credit score used when evaluating your credit trustworthiness as there's no distinction between you and your business. As such, you'll always want to ensure your personal finances are healthy, but you won't have the added pressure of looking after a separate business score as well.

If you're a startup that's been founded as a limited company, your personal and business credit scores are usually considered separate and won't influence each other at all – positively or negatively. It's only in the early days, when your business has a short history that your personal finances may be considered as well. This is often done because your business won't yet have a meaningful record of loans or repayments.

The analysis of personal credit scores may be done on any directors named to your startup so if you have any key business partners, encourage them to take a look at their personal finances as well. It is possible that despite your own credit score being excellent, your company is rejected for a loan due to the poor credit score of your partner.

So, while it may not always be considered, if you're in the early stages of starting a business, your personal credit score may influence your business' ability to take out loans. Exactly how it will affect your business can depend on the situation and the type of business you manage, but you'll want to make sure your personal credit score is as high as possible.

Work hard, insure easy

Running a business is hard work. That’s why we’re doing all we can to make your insurance a bit easier. From helping you tailor your policy to your unique business needs, to taking the guesswork out of finding business insurance, find out what we’re doing to help small businesses.