Passing your driving test is a rite of passage for many teenagers. With it comes a newly found freedom to go where you want, when you want.

If you’ve recently passed your driving test, congratulations. We’re sure you’re already eyeing up your first car. But before you’re ready to hit the road, you’ll need to think about car insurance, it is a legal requirement after all.

You may already have some kind of insurance – either as a learner on your parents’ policy or a separate learner driver policy. If that’s the case, make sure you let your insurance provider know that you’ve passed. Some of these policies automatically end once you’ve passed your test, so you’ll want to check to see if you need to get a new car insurance policy.

To help get you up to speed, let’s look at who is classed as a young driver, why insurance can cost them more and how you can keep your insurance price down.

Who is classed as a young driver?

A young driver is typically someone aged 17-25. So, even if you passed your driving test at 17, and you’ve been driving for 5 years, you’d still fall under this category.

In general, people in this age bracket are viewed as newer and inexperienced drivers. Because of this, car insurance can be more expensive when compared to other age groups.

Why does insurance cost more for younger drivers?

A lot of it comes down to experience. The more time you’ve spent on the road without accidents, the safer you look to insurance companies. However, when you’re hitting the road for the first time, you haven’t got those years of experience compared to everyone else. Of course, over time you’ll be able to build on those years of driving without any claims, and this will bring down the cost of your car insurance.

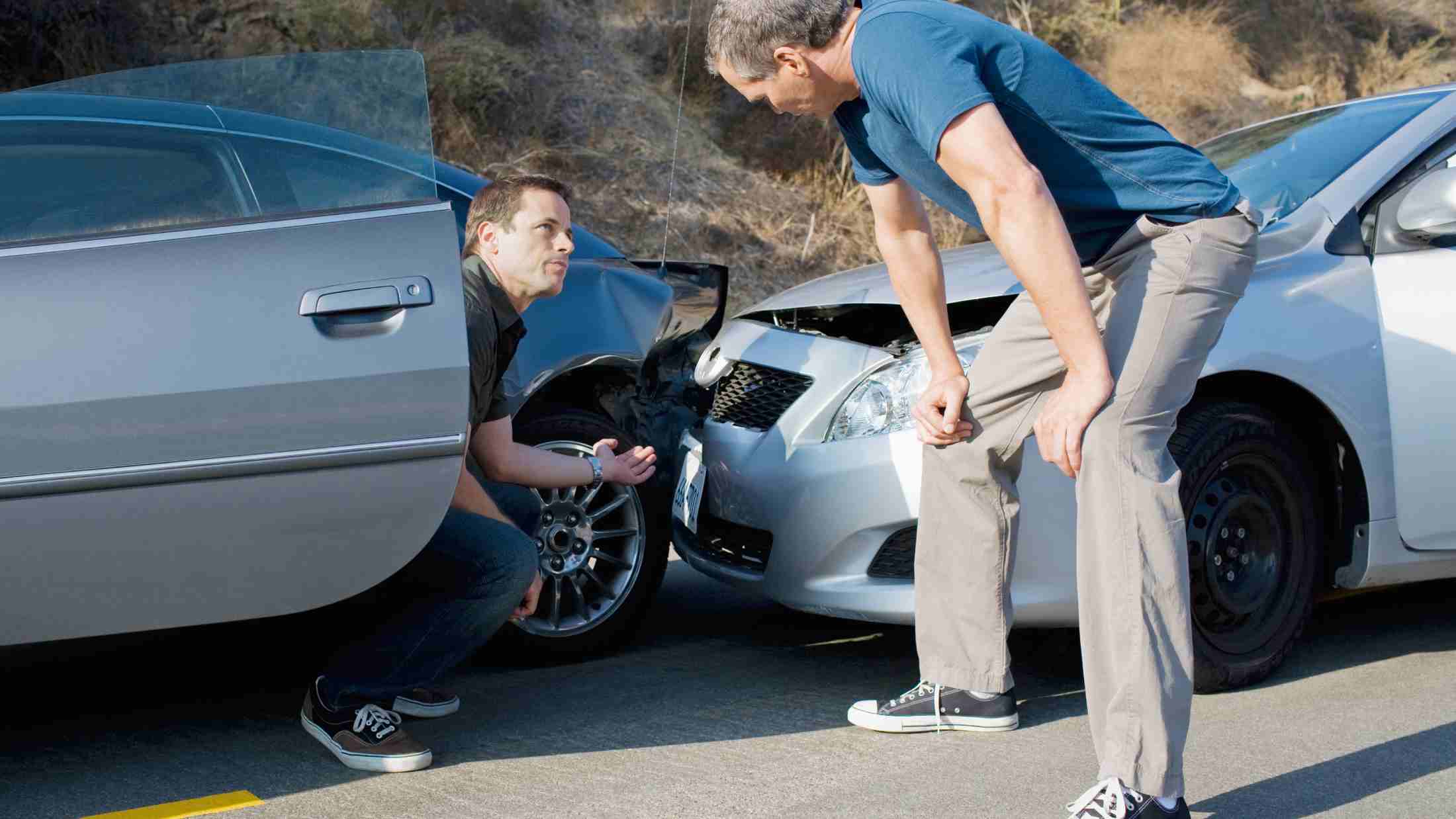

Statistically speaking, younger drivers are also more likely to be involved in accidents. According to brake.org, 1 in 5 young drivers are involved in a crash within their first year, and over 1,500 are killed or seriously injured in a car accident every year. This also adds to the cost of car insurance. As you’re in a risky age bracket, the chances of you having an accident are higher. We know this may feel unfair for those of you that drive safely. The good news is that, if you are the policyholder for your car insurance, you can earn a no claims discount (NCD) for each year you drive without an accident. Over time, these years of NCD should help you bring down your car insurance cost.

What kind of insurance can I get with AXA?

With AXA car insurance, you’re able to choose from the same level of cover as anyone else.

That means you have the choice of comprehensive insurance or third-party, fire and theft car insurance. The main difference between the two is that comprehensive car insurance will cover your car for damage, even if it’s your fault. You also won’t be able to choose a voluntary excess level with third-party, fire and theft. Having a higher voluntary excess can help you reduce your car insurance price, so it’s worth keeping that in mind. However, you’re best off looking at what each type of cover gives you so you can work out what would work best for you.

How to keep your insurance price down

While car insurance may seem expensive for new drivers, there’s a few things you can do to help bring your price down:

Choosing your car – everyone wants a flashy car, don’t they? Well, as a younger driver, the type of car you choose will have an impact on the price of your insurance. Every car is grouped from 1 to 50, with 1 being the cheapest to insure. So, before you pick out your car, take a look at what car insurance group it falls in to.

Paying a higher voluntary excess – there’s two different types of excess: voluntary and compulsory. While you can’t choose how much your compulsory excess is, you can for your voluntary. A higher excess tends to bring down the price of your car insurance. However, make sure you don’t end up choosing a total excess level which is higher than the value of your car. If you do this, you may not be able to make a claim for any damage to your car.

Adding a safe driver to your policy – this tends to be a parent or family member. Having a more experienced driver on your policy may help bring down the price. However, they can’t be added as the main driver if you’re going to be driving the car most of the time. This is called fronting and it’s illegal. This also means you can’t have your parent as the policyholder or main driver and yourself as a named driver, if you’re going to be the person who drives the car most of the time.

Paying your insurance upfront – when you pay for car insurance, you’ll normally have a choice to pay monthly or yearly. If you can, you should try to pay for it yearly, as this will work out cheaper in the long-run compared to monthly payments.

These tips should help you bring down your insurance price as much as possible. We know that it can be frustrating that you have to pay more because of your age. However, by driving safely and building up your NCD, you should hopefully start to see your price come down over time.

Time to get on the road

We hope you’re looking forward to getting behind the wheel. Being able to drive really does open up a whole new world to you. While the higher car insurance costs for younger drivers may be frustrating, we hope you find our tips on lowering it helpful. Safe driving!